Thacker Pass lithium project gets $2.26 billion DOE loan | US's new bill on deep-sea mining

Weekly mining & batteries updates (Mar 11 - 17)

What’s big this week?

Minerals/Mining: US's new bill on deep-sea mining; Saudi doubles down on metals mining; Thacker Pass secures $2.26B DOE loan; Investors urge Glencore to relist in Australia; political interference in Vale's CEO election.

Batteries/EVs: CATL 24Q4 earnings drop YoY; CATL-Nio collaborates on longer-life batteries; Goldman sees lower battery prices boosting EV demand.

Minerals/ Mining

US lawmakers urge funding for deep-sea mining in new bill. “The Responsible Use of Seafloor Resources Act of 2024, which is sponsored by Rep. Carol Miller (R., W.Va.) and Rep. John Joyce (R., Pa.), pushes for federal agencies to ‘provide financial, diplomatic, or other forms of support for seafloor nodule collection, processing and refining where upstream sourcing is compliant with regulations.’”

-

Saudi Arabia wants to extract over $2.5 trillion worth of metals domestically, invest globally in mineral extraction, and secure involvement across the entire minerals value chain. Mining has been designated as an additional "pillar" of its industrial foundation in Saudi’s "Vision 2030", offering a new economic foundation to counter the eventual decline of fossil fuels.

-

The US's largest lithium-mining project, the Thacker Pass mine, is set to receive a $2.26 billion loan from the DOE to build a refining plant. Lithium Americas anticipates that the loan, expected to close in the coming months, will cover the majority of the project's total cost of $2.93 billion.

This is the DOE Loan Office's largest-ever loan to a mining company.

Thacker Pass mine is expected to initially yield 40,000 metric tons of battery-grade lithium per year, sufficient for up to 800,000 EVs annually, as per DOE. Production is expected to start in 2027.

General Motors, with a $650 million investment in Lithium Americas, has an exclusive offtake agreement for 100% of the mine's lithium production for up to 15 years starting in 2027.

-

Tribeca Investment Partners, an Australian hedge fund, urged Glencore to improve its stock value by keeping its coal division, relocating its primary listing to the Australian Securities Exchange, increasing dividends by ending share buybacks, and considering an IPO for part of its trading division.

Tribeca noted that Glencore delivered a 9% shareholder return since its 2011 listing, far behind BHP's 95% and Rio Tinto's 126%.

“The London Stock Exchange (LSE) has a comparatively low appetite for mining investment and is no longer suitable as the company’s primary bourse”. Mining companies are eyeing alternative stock exchanges like New York, Sydney, and Toronto for higher valuations, following BHP's decision to move its primary listing to Australia in 2022.

Glencore’s ordinary shares are currently listed on the LSE’s main market, with a secondary listing on the Johannesburg Stock Exchange (JSE). In comparison,

Rio Tinto is structured as a dual-listed company, with listings on both the LSE under the name "Rio Tinto Plc", and the Australian Securities Exchange (ASX) under the name "Rio Tinto Limited".

BHP has its primary listing at AXS, Secondary listing at JSE, standard listing at LSE and ADR traded at NYSE.

-

An independent director at Vale resigned from its board, citing concerns of "nefarious political influence" in the CEO selection process. The major iron ore supplier is embroiled in controversy over its leadership succession, with accusations of government interference. José Luciano Duarte Penido's departure highlights concerns about manipulated processes that neglect the company's best interests.

-

Chinese nickel sulfate prices surged to a four-month peak in late February as NCM cathode makers restocked amidst supply constraints post-Chinese Spring Festival, spurred further by production cuts by nickel producers in China and Indonesia.

Batteries/ EVs

CATL’s Q4 2024 earnings fell 1.2% YoY, marking the first decline since early 2022.

This decline raises concerns due to overcapacity in the battery sector. For example, China's battery factory utilization rate fell to 70% in 2023 from 83% in 2022. Goldman Sachs has revised down its forecast for global battery demand growth in 2024 to 29%, down from the previous projection of 35%.

CATL, holding 36.8% of the global market share, appears optimistic as it is constructing a new facility expected to increase its total production potential by around a fifth from the more than 500-gigawatt hours it already has by the end of 2023.

Goldman Sachs also predicts lower metal prices will lead to a nearly 40% decline in battery prices between 2023 and 2025. This is significant as it is expected to bring EVs closer to cost parity with internal combustion engine (ICE) cars in certain markets by next year. This is good news for EVs to gain a larger share of car sales, as Goldman also projects EVs to reach 50% in the US and 68% in the EU by 2030.

Another update from CATL is that it is teaming with NIO to develop longer-life batteries, to lower overall EV costs. The partnership aims to reduce the "full life cycle" costs of batteries, key for Nio's battery-swapping and charging stations.

-

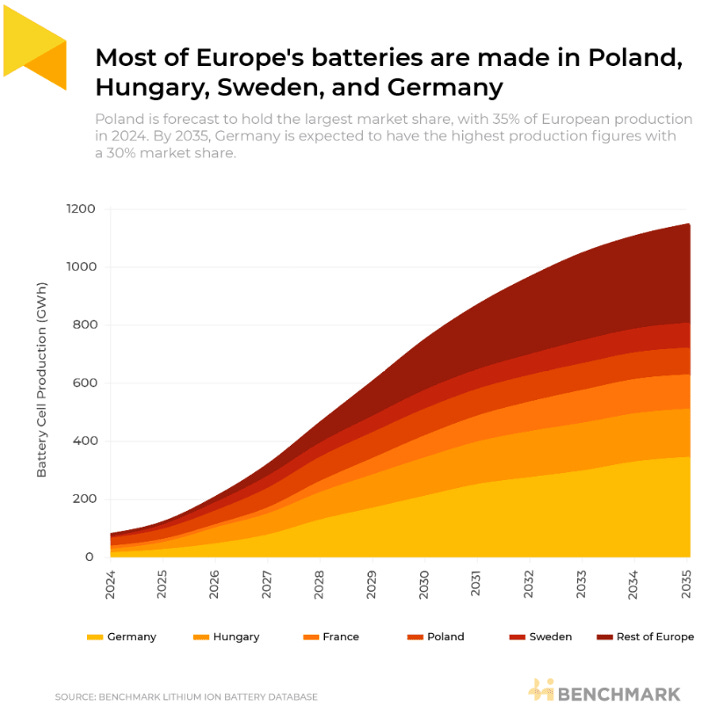

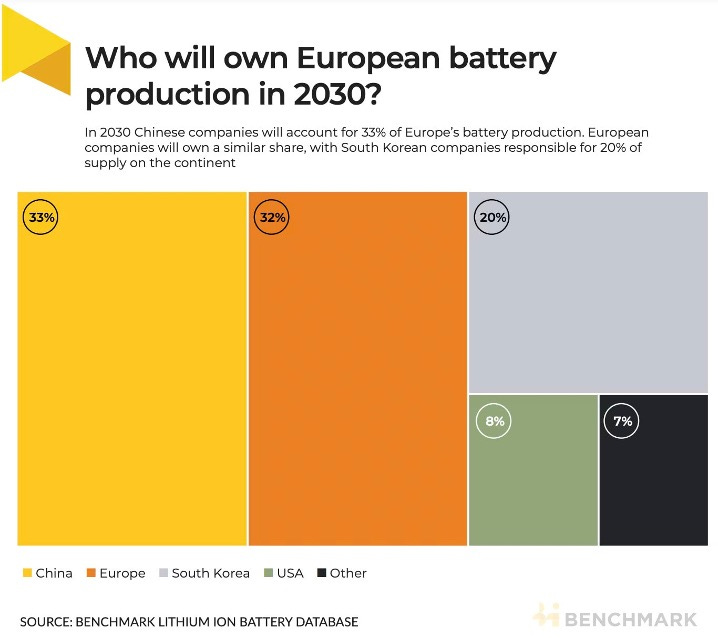

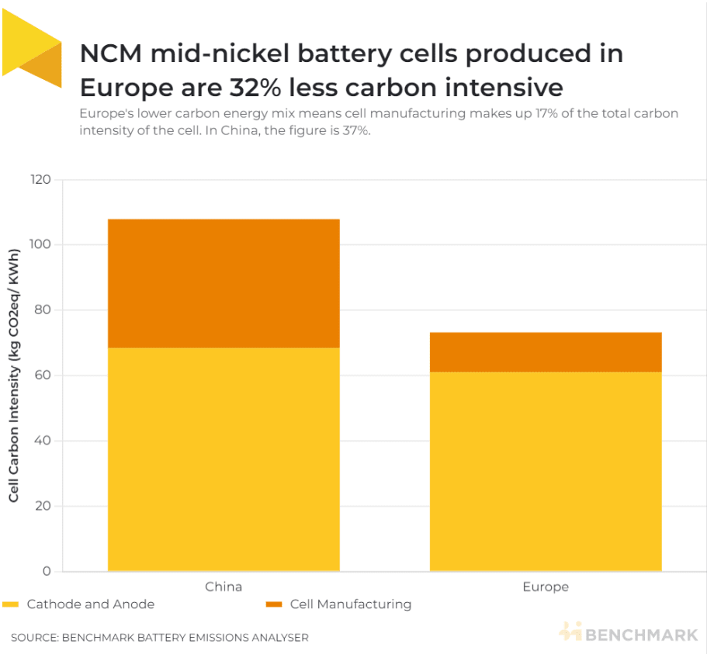

Some interesting charts from Benchmark about the European battery market:

If you enjoy our weekly doses of mineral news, please share it with people around you who may also like it -

If you have not yet subscribed to us, oh well here you go -