How BYD foresaw itself overtaking Toyota back in 2007...

A book review on BYD's 30 years of history

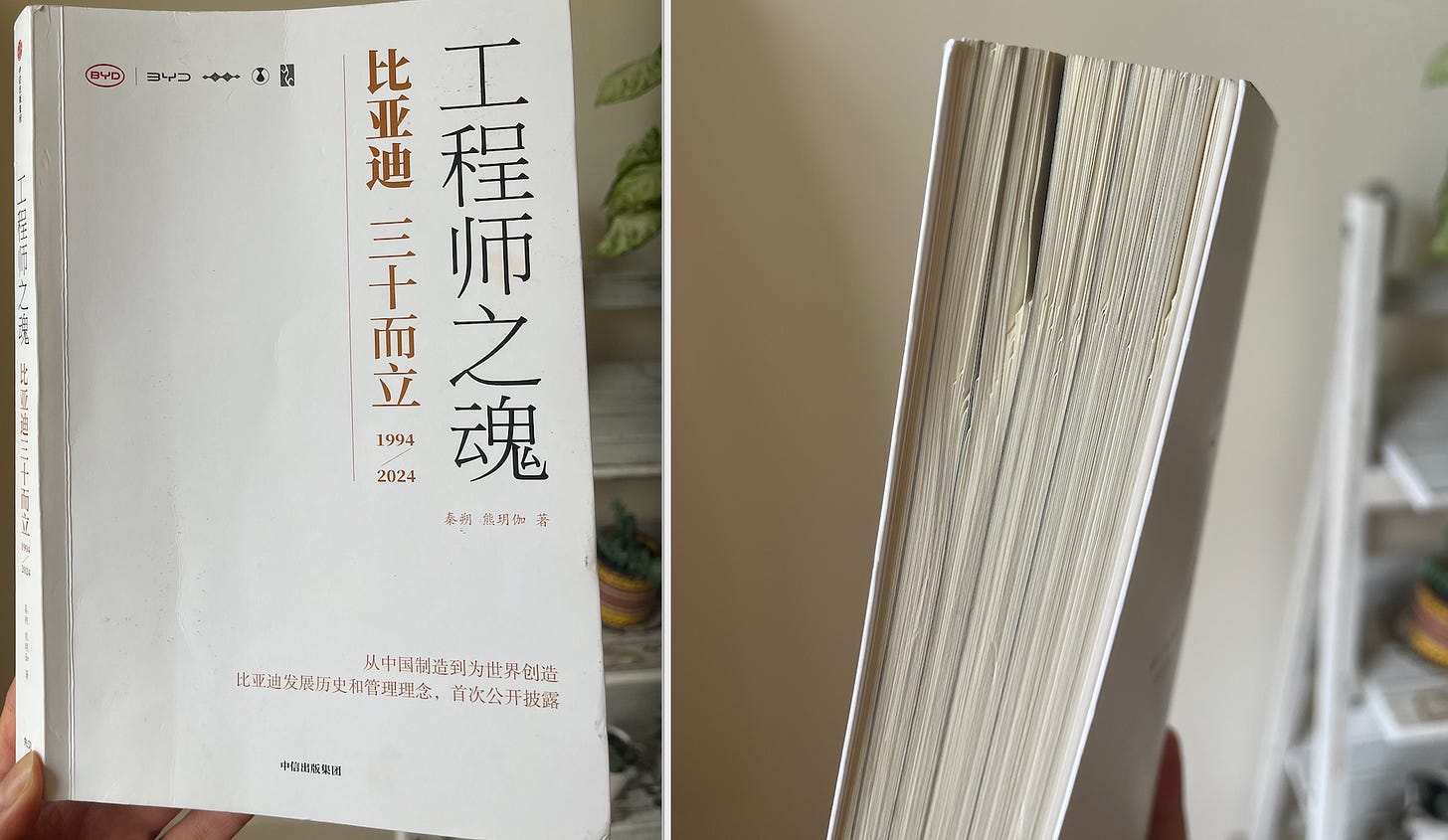

Hi, I’m back from months of a tea hiatus - a lot has happened in the critical minerals, batteries, and EV space. We have a lot to unpack for all things critical minerals related, but for this comeback piece (**vroom vroom**), I thought it’d be fun to share with you a book I recently read called The Soul of an Engineer: BYD at Thirty (1994–2024).

The book is said to be the only official BYD biography recognized by the company. Written by well-known Chinese financial journalist Shuo Qin, the book draws on interviews with dozens - if not hundreds - of BYD’s management team, investors, and employees. The book was just published late last year and, as far as I know, is currently only available in Chinese. So hopefully, this article can serve as a fun teaser for some of you for now :)

As the title suggests, the book focuses on BYD’s engineer-driven culture. The founder, Chuanfu Wang, is an engineer by training, and the text is also sometimes filled with technical jargon. The narrative follows a chronological arc, starting with Wang’s childhood, his decision to leave a stable office job to start a company, Warren Buffett’s later investment, and BYD’s rapid global expansion to where it stands today.

In 2024, BYD has overtaken Tesla as the world’s largest electric carmaker, both in vehicles sold and total revenue. For FY2024 , BYD posted solid 40% year-on-year growth, selling twice as many electric vehicles (including both battery-electric and plug-in hybrids) as Tesla, whose global annual sales declined in the same year. In pure battery-electric vehicle sales, BYD is now nearly on par with Tesla — delivering 1.76 million units last year, compared to Tesla’s 1.79 million.

For this write-up, I’ve condensed some of the most memorable stories and key lessons from the book into bullet points below.

BYD has come a long way to become an EV maker

Demystifying BYD’s integrated supply chain

Founder’s personality and company culture

BYD has come a long way to become an EV maker

For some of you who aren’t as familiar with BYD, it might be amusing to learn that BYD makes far more than just cars. The company actually started by manufacturing nickel batteries for early "brick" mobile phones, eventually becoming a supplier to major brands like Motorola and Nokia. Even today, about a quarter of BYD’s revenue still comes from its handset business.

Establishing overseas production isn’t new for BYD either. While BYD’s latest wave of global EV expansion has attracted a lot of attention, especially in Europe, its international ambitions actually date back much further. In 2008, BYD entered Europe by acquiring a handset company called Mirae Industry. Interestingly, the acquisition essentially involved buying the company's fixed assets while dismissing most of its licensed patents – because BYD is said to have mastered the underlying technologies.

If batteries, phones, and cars seem like a logical progression, it was quite surprising for me to learn that BYD also built a monorail system. In 2017, the company launched "SkyRail" in Yinchuan, a city in northwestern China – an elevated driverless monorail designed to ease urban congestion more affordably and quickly than traditional subways (photos below). More recently, at the onset of COVID-19 in 2020, BYD again demonstrated its manufacturing agility by converting production lines to produce masks and mask-making machines.

Okay, back to cars — so how did BYD get into making EVs?

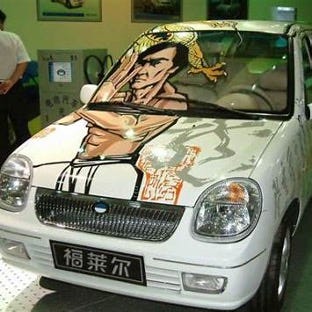

After building a strong presence in battery and handset manufacturing, BYD set its sights on bigger ambitions. It made two unsuccessful attempts to acquire semiconductor businesses before pivoting to the automotive sector. In 2003, BYD entered the car business by acquiring Qinchuan Auto, a struggling Chinese automaker. More important than the company itself was the automotive manufacturing license that came with the deal. Qinchuan was best known for producing ultra-low-end mini cars called the Flyer, which sold for about $2,000 back then - with a razor-thin margin of just $5 per vehicle (*crazy*).

Also in case you are curious, the car looks like this »»»

Wang’s decision to enter the EV market was driven by two insights: first, that Chinese companies were decades behind Western automakers in gasoline vehicles, with little hope of catching up; and second, that BYD’s strength in batteries could offer an edge in the emerging EV space. At the time, car ownership in China was just beginning to boom. This raised questions to Wang: “Where will all future gasoline come from to power these cars in China? And what about the air pollution?”

In an interview with CNN, Wang recalled how investors yelled at him, saying, “You don’t even have a driver’s license — how can you make cars?” when BYD announced its entry into the car business. Despite the backlash, Wang pressed ahead. However, instead of jumping straight into EVs, he adopted a so-called “walk with both legs” strategy: one leg in traditional gasoline vehicles to learn the fundamentals of car making, and the other in developing EV technologies for when the market was ready.

In 2004, just a year after acquiring Qinchuan, BYD launched its first car, the 316 – essentially a reworked version of the Flyer. The model was discontinued a day after it came off the production line, due to poor early feedback from their distributors.

To improve beyond simple remodeling, BYD decided to learn from its global peers by reverse-engineering imported cars. Many of the patents on these cars had expired after decades, allowing BYD to study the fundamentals of these technologies. An interesting anecdote here: Wang purchased several foreign cars for BYD’s engineers to tear down and study. The engineers were hesitant at first to break down expensive imported cars. Instead, Wang picked a Mercedes-Benz, circling a key around the surface to scratch off the paint, sending a clear message: "Go ahead, break them down and learn."

Demystifying BYD’s integrated supply chain

The "integrated supply chain" has become a major buzzword in recent years, and tariffs have only sparked more discussion about it. BYD is often “praised” for its integrated supply chain - imagine a company that even builds its own ships to deliver vehicles overseas. However, from reading the book, I get the sense that this seemingly strategic move was less about foresight but more born out of “constraints”.

In 1997, the company couldn’t afford expensive Japanese battery manufacturing equipment and had to develop capabilities in-house. By 2004, when entering the automotive industry, BYD initially sought external suppliers. However, most domestic suppliers were tied to foreign automakers — Japanese, Korean, American, and German brands — and only served Chinese companies when they had surplus capacity. This forced BYD to break from the traditional automaker model of focusing solely on stamping, welding, painting, and final assembly, and instead build a more self-reliant supply chain.

While integrated production is often celebrated for enhancing security and resilience, it also brought challenges like complacency and slower innovation. In-house suppliers, assured of downstream demand, had less incentive to push boundaries. To address this, BYD began introducing top foreign suppliers in 2016 to inject competition and drive innovation, while still benefiting from the agility of its internal supply chain. In 2019, it spun off its battery business into FinDreams Battery Co., Ltd. (弗迪电池).

On a separate note, while much of the discussion around how Chinese companies have benefited from globalization focuses on technology transfer from Western firms, I think another crucial factor often overlooked is the transfer of management knowledge. From reading the book, it struck me that one thing Chinese companies probably improved much from being part of the global supply chain is enhanced quality control. BYD, for example, improved its manufacturing capabilities by supplying major international companies like Nokia and Motorola.

The head of BYD's lithium-ion workshop shared an example: "Whenever there was an issue, Motorola required us to submit an 8D report, asking detailed ‘why’ questions. There was no room for shortcuts. The report couldn’t just suggest ‘employee training’ because people are variable — it had to focus on improving processes, formulas, and equipment." The process was rigorous: provide a temporary solution within 24 hours, offer improvement measures within 48 hours, and submit a detailed 8D report within 72 hours. Within five days, a formal report was required, and the effectiveness of the corrective measures was verified within seven working days or with the first three batches of shipments.

Founder’s personality & company culture

The book opens with Wang’s upbringing, telling how losing both of his parents at a young age helped shape his fiercely independent character. With his engineering background, Wang is deeply hands-on when it comes to any new technologies.

Wang is known to be quite down-to-earth. Li Lu — the lead investor who facilitated Warren Buffett’s investment in BYD — said that, during a 2023 trip to South America to research the automotive market with BYD’s team, "Chuanfu was exactly the same as when we first met — eating simple meals, jumping off the bus to conduct site inspections and ask questions, getting back on the bus to hold meetings and analyze findings. For him, work is life.”

Wang appears to have fewer international public appearances now, but he was once known for making bold statements

In 2007, when BYD rolled the F6 model off its production line, Wang delivered a speech claiming that BYD aimed to become China’s top carmaker by 2015 and the world’s number one by 2025. In another 2009 media interview I dug up, he predicted that BYD would overtake Toyota as the world’s largest automaker by 2025 - a claim that definitely sounded wild back then but feels a lot less far-fetched today.

In another interview with CNN back in 2010, Wang predicted that EVs would reach price parity with gas cars within 10 years, factoring in government subsidies like those from China and the Obama administration. After that point, he believed automakers would benefit from economies of scale and falling production costs. He believed that, at the time, the main constraints were limited production capacity and the need for further technological improvements. In that same interview, Wang demonstrated an EV model that required a special charging station — otherwise, it would take two days to fully charge using a standard household outlet.

The book summarizes BYD’s core culture as "Compete, Learn, Support, and Succeed Together" (比学赶帮胜). Competition is emphasized first. The company also provides extensive facilities for its employees, including schools and accommodations. Employees are encouraged to "work at BYD, marry BYD colleagues, drive BYD cars, live in BYD communities, and send their children to BYD schools."

Overall, I think this book gives a pretty comprehensive look at BYD’s history and how far the company has come — from a little-known brand people used to look down on to an internationally recognized name today. I don’t have many critiques about the book itself, though sometimes the wording feels a bit broad. There is this one small part I found kind of funny: the author points out that most news coverage about BYD’s acquisition of Ningbo SinoMOS Semiconductor wasn’t very insightful — except for a piece from Shanghai First Finance Media Limited. And I was wondering... wasn’t the guy himself formerly the editor-in-chief there lol

The book also mentions many technologies that BYD has invested in, referring to it as their “technology fish pond.” Essentially, BYD has this pool of technological "fish" and grabs one to use when the time is right, all while continuing to invest in various technologies. I’m keeping this post as a company primer, making it as easy and fun to read as possible, so I didn’t dive into the details of many technologies mentioned. But if you’d like to know more about BYD’s technology “fish pond”, feel free to comment below, and I may write another follow-up piece :)